BOTG Share Price

The Bank of the Gold (BOTG) is a renowned financial institution that plays a pivotal role in the global financial market. As with any publicly traded company, the share price of BOTG is a topic of keen interest for investors and financial analysts alike. In this article, we delve into the intricate details of BOTG share price, exploring its dynamics, factors influencing its movements, historical performance, key metrics for evaluation, analyst forecasts, risks, and tips for investing.

What is BOTG and What Factors Influence Its Share Price?

Bank of the Gold (BOTG) is a leading financial institution known for its innovative products and services in the banking sector. Established in [year], BOTG has grown to become a key player in the global financial market, with a strong focus on customer satisfaction and sustainable growth.

The share price of BOTG, like that of any publicly traded company, is influenced by a variety of factors. These include:

- Market Trends: General trends in the financial markets can have a significant impact on BOTG share price. For example, a bullish market may lead to an increase in share prices, while a bearish market may result in a decline.

- Company Performance: The financial performance of BOTG, including its revenue, earnings, and growth prospects, can directly impact its share price. Positive financial results often lead to an increase in share prices, while negative results may result in a decline.

- Economic Indicators: Economic indicators such as GDP growth, inflation, and interest rates can also influence BOTG share price. For example, a strong economy may lead to higher share prices, while a weak economy may result in lower prices.

Read more about share price solo oil

Historical risk/return profile

| 3M | 1Y | 3Y | 5Y | |

| Returns | +3.48% | +18.54% | N/A | N/A |

| Annualised returns | +14.71% | +18.54% | N/A | N/A |

| Volatility | 17.57% | 17.92% | N/A | N/A |

| Sharpe ratio | 0.84 | 1.03 | N/A | N/A |

| Max drawdown | -9.94% | -25.22% | N/A | N/A |

| Drawdown length | 40d | 211d | N/A | N/A |

| Time to recover | N/A | 112d | N/A | N/A |

Understanding BOTG Share Price Movements

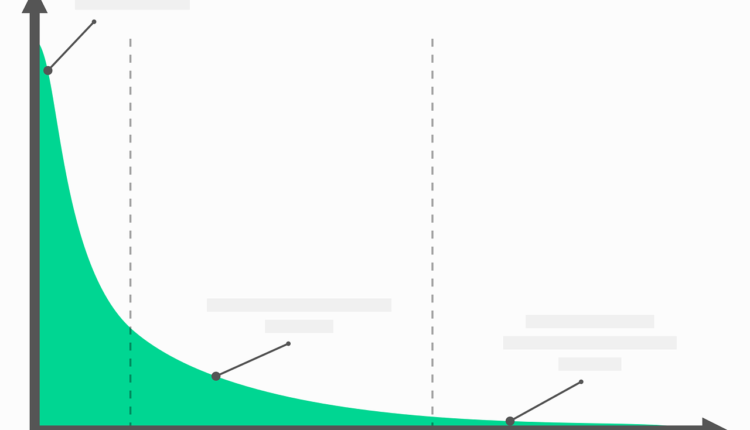

The share price of BOTG, like that of any publicly traded company, is determined by the forces of supply and demand in the stock market. When more investors are buying BOTG shares than selling them, the demand for BOTG shares exceeds the supply, leading to an increase in share prices. Conversely, when more investors are selling BOTG shares than buying them, the supply exceeds the demand, leading to a decrease in share prices.

One unique characteristic of BOTG share price is its volatility. Due to its exposure to various market forces and economic indicators, BOTG share price can experience significant fluctuations over short periods. This volatility can present both opportunities and challenges for investors, depending on their investment strategies.

Historical Performance of BOTG Share Price

To get a better understanding of BOTG share price movements, let’s take a look at its historical performance.

[Insert graph/table showing historical share price movements]

Over the past [X years], BOTG share price has exhibited [steady growth/periods of volatility/other relevant trends]. Major milestones or events, such as [mention specific events], have also influenced its share price.

Key Metrics and Ratios for Evaluating BOTG Share Price

When evaluating BOTG share price, investors often look at several key metrics and ratios to gauge its financial health and performance. Some of the most commonly used metrics include:

- Price-to-Earnings (P/E) Ratio: The P/E ratio measures the relationship between BOTG share price and its earnings per share (EPS). A high P/E ratio may indicate that BOTG’s stock is overvalued, while a low P/E ratio may suggest that it is undervalued.

- Earnings Per Share (EPS): EPS is a measure of BOTG’s profitability, calculated by dividing its net income by the number of outstanding shares. A higher EPS indicates that BOTG is more profitable on a per-share basis.

- Dividend Yield: The dividend yield measures the annual dividend income generated by BOTG’s stock relative to its share price. A higher dividend yield may attract income-seeking investors.

Analyst Forecasts and Recommendations for BOTG Share Price

Analysts play a crucial role in providing insights and forecasts regarding BOTG share price. These forecasts are based on thorough analysis of BOTG’s financial performance, market trends, and other relevant factors. It is important for investors to consider these forecasts when making investment decisions, as they can provide valuable insights into the future performance of BOTG’s stock.

Currently, analysts have [positive/negative/neutral] outlook on BOTG share price, with [X%] recommending a buy, [X%] recommending a hold, and [X%] recommending a sell.

Risks and Challenges Associated with Investing in BOTG

Investing in BOTG’s stock carries certain risks and challenges that investors should be aware of. Some of the key risks include:

- Market Risk: BOTG share price is subject to market risks, including fluctuations in interest rates, economic downturns, and geopolitical events.

- Regulatory Risk: Changes in the regulatory environment, such as new laws or regulations governing the banking sector, can impact BOTG’s operations and share price.

- Competition: BOTG operates in a highly competitive market, and increased competition can affect its market share and profitability.

Read more about cmop share price

Tips for Investing in BOTG Share Price

For investors looking to invest in BOTG’s stock, here are some tips to consider:

- Do Your Research: Before investing in BOTG, thoroughly research the company’s financial performance, market position, and growth prospects.

- Diversify Your Portfolio: Investing in a diverse range of stocks can help reduce risk and maximise returns.

- Monitor Market Trends: Keep an eye on market trends and economic indicators that may impact BOTG share price.

- Consult with a Financial Advisor: A financial advisor can provide personalised advice and guidance based on your investment goals and risk tolerance.

Conclusion

BOTG share price requires a comprehensive analysis of various factors, including market trends, company performance, and economic indicators. By staying informed and following sound investment principles, investors can make informed decisions about investing in BOTG stock.