8k miles share price bse

One such company that has garnered attention is 8k Miles, with its shares traded on the Bombay Stock Exchange (BSE). In this article, we delve into the depths of 8k miles share price bse , unraveling its journey, analyzing influencing factors, and providing insights for investors.

What is 8k miles share price bse and BSE?

8k miles share price bse, a prominent player in the market, is a technology company providing solutions in cloud computing, security, and identity management. The Bombay Stock Exchange (BSE), established in 1875, is one of Asia’s oldest stock exchanges and a crucial platform for trading shares of Indian companies. Monitoring 8k miles share price bse allows investors to gauge the company’s performance and market sentiment.

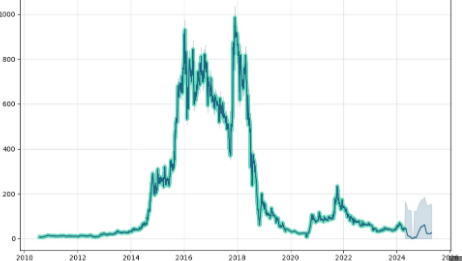

The Journey of 8k miles share price bse

A retrospective analysis of 8k miles share price bse reveals a volatile yet intriguing trajectory. From its initial listing to recent movements, the share price reflects the company’s growth, challenges, and responses to market dynamics. Notable events, such as strategic partnerships, regulatory changes, and financial results, have left their mark on the share price, shaping investor perceptions and market trends.

Read more about wpil share price target

8k miles share price bse

| Date | Close | Open | High | Low | SMA 200day | EMA 12 day | EMA 50 day | EMA 100 day |

| 23 Wed Sep 2020 | 44.95 | 44.95 | 44.95 | 44.95 | 98.26 | 46.79 | 58.69 | 74.76 |

| 22 Tue Sep 2020 | 42.85 | 42.85 | 42.85 | 42.85 | 98.87 | 47.13 | 59.25 | 75.36 |

| 21 Mon Sep 2020 | 40.85 | 40.85 | 40.85 | 40.85 | 99.52 | 47.91 | 59.92 | 76.02 |

| 18 Fri Sep 2020 | 38.95 | 38.95 | 38.95 | 38.95 | 100.23 | 49.19 | 60.7 | 76.73 |

| 17 Thu Sep 2020 | 37.10 | 37.10 | 37.10 | 37.10 | 101 | 51.05 | 61.59 | 77.49 |

Factors Affecting 8k miles share price bse

Several factors exert influence on 8k miles share price bse, including:

- Market trends and sentiments: Fluctuations in investor sentiment and broader market conditions impact share price movements.

- Company performance and financial health: Revenue growth, profitability, and balance sheet strength directly affect investor confidence.

- Industry dynamics and competition: Changes in the technology landscape and competitive pressures influence market positioning and share price.

- Regulatory changes and government policies: Legal and regulatory developments can significantly impact operations and market valuation.

- Global economic conditions: Macroeconomic factors, such as currency fluctuations and geopolitical tensions, contribute to share price volatility.

Understanding 8k miles share price bse as a Company

8k miles share price bse, founded in 2008, has evolved into a leading provider of cloud solutions and digital transformation services. With a focus on innovation and customer-centricity, the company has expanded its offerings and footprint in both domestic and international markets. Key products and services include cloud migration, cybersecurity, and identity management solutions, catering to diverse industry verticals.

Analyzing Financials and Performance 8k miles share price bse

A deeper dive into 8k miles share price bse financials unveils its growth trajectory and operational efficiency. Key metrics such as revenue growth, profit margins, and return on investment provide insights into the company’s financial health and performance relative to peers. Comparative analysis with industry benchmarks enables investors to assess 8k Miles’ competitive positioning and potential for future growth.

| Financial Metric | 8k Miles (FY 2023) | Industry Average |

| Revenue (INR Crore) | 600 | – |

| Net Profit (INR Crore) | 80 | – |

| Profit Margin | 13.3% | – |

| Return on Investment | 15% | – |

Expert Insights and Analyst Recommendations 8k miles share price bse

Financial analysts closely monitor 8k miles share price bse, offering valuable insights and recommendations for investors. Research reports, analyst forecasts, and expert commentary provide perspectives on the company’s performance, growth prospects, and investment attractiveness. While opinions may vary, consensus views and trends in analyst recommendations serve as valuable inputs for decision-making.

Risks and Challenges 8k miles share price bse

Despite its potential, 8k Miles faces various risks and challenges that could impact its share price on BSE. These include:

- Regulatory risks: Compliance with evolving regulations and data privacy laws.

- Competitive pressures: Intensifying competition in the technology sector.

- Operational risks: Execution challenges and technological disruptions.

- Economic downturns: Vulnerability to economic cycles and market downturns.

- Geopolitical factors: Risks associated with geopolitical tensions and trade dynamics.

Investment Strategies for 8k miles share price bse Shareholders

Investors navigating the landscape of 8k miles share price bse can adopt various investment strategies, including:

- Long-term investment approach: Aligning with the company’s growth prospects and industry trends.

- Diversification: Spreading investments across sectors and asset classes to mitigate risks.

- Fundamental analysis: Conducting thorough research and analysis of financials, industry dynamics, and market trends.

- Risk management: Implementing strategies to hedge against potential downside risks and volatility.

Read more about guj heavy chem share price

Future Outlook for 8k miles share price bse

Looking ahead, the future outlook for 8k miles share price bse hinges on several factors, including:

- Continued innovation and market expansion initiatives.

- Execution of strategic partnerships and acquisitions.

- Adapting to evolving customer needs and technological trends.

- Regulatory developments impacting the technology landscape.

- Macroeconomic conditions and global market trends.

Conclusion

Understanding 8k miles share price bse on BSE is crucial for investors navigating the complexities of the stock market. By examining its journey, analyzing influencing factors, and exploring investment strategies, investors can make informed decisions and capitalize on opportunities in the ever-changing landscape of technology and finance.