SUK2 Share Price

In the world of investing, understanding share prices is crucial for making informed decisions. One such share price that investors often track is that of SUK2. In this guide, we will delve into the details of SUK2 share price, including what it is, why it matters, and how it is calculated. We will also explore the factors influencing SUK2 share price, historical performance, and forecasting methods. By the end, you will have a thorough understanding of SUK2 share price dynamics and be better equipped to navigate the world of investing.

What is SUK2?

SUK2 is a stock symbol that represents a specific company in the financial markets. It is important to note that SUK2 is a hypothetical stock symbol used for illustrative purposes in this guide. When referring to actual stocks, it is important to use the correct stock symbol and conduct thorough research.

SUK2 share price

| Issuer | GO UCITS ETF Solutions Plc |

| Structure | ETF |

| Replication method | Swaps |

| Securities lending | No |

| Number of holdings | n/a |

| Size | n/a |

| Launch date | 01 June 2009 |

| Launch price | £108.33 |

| UCITS | Yes |

| Reporting status | Yes |

| Domicile | Ireland |

| Complex product | Complex |

| ISIN | IE00B4QNK008 |

Why Monitor SUK2 Share Price?

Monitoring SUK2 share price is important for investors and shareholders for several reasons. Firstly, it provides insight into the performance of the company represented by the stock symbol. Changes in SUK2 share price can indicate shifts in market sentiment, industry trends, or company performance. Additionally, monitoring SUK2 share price allows investors to make informed decisions about buying, selling, or holding the stock.

Read more about rbtx share price

Factors Influencing SUK2 Share Price

Several factors can influence SUK2 share price, including:

- Company Performance: The financial health and performance of the company represented by SUK2 can have a direct impact on its share price. Strong financial results and growth prospects can lead to an increase in share price, while poor performance can result in a decrease.

- Industry Trends: Trends and developments within the industry in which SUK2 operates can also influence its share price. For example, regulatory changes, technological advancements, or shifts in consumer behavior can impact the company’s outlook and, consequently, its share price.

- Economic Indicators: Economic indicators, such as interest rates, inflation, and GDP growth, can affect SUK2 share price. Changes in these indicators can impact investor sentiment and overall market conditions, influencing share price movements.

- Regulatory Environment: Changes in the regulatory environment can impact SUK2 share price. For example, new regulations or legal issues facing the company can affect its operations and financial performance, ultimately impacting its share price.

How is SUK2 Share Price Calculated?

SUK2 share price is determined by the forces of supply and demand in the stock market. When there is high demand for SUK2 shares and limited supply, the share price tends to increase. Conversely, when there is low demand and high supply, the share price may decrease.

Historical Performance of SUK2 Share Price

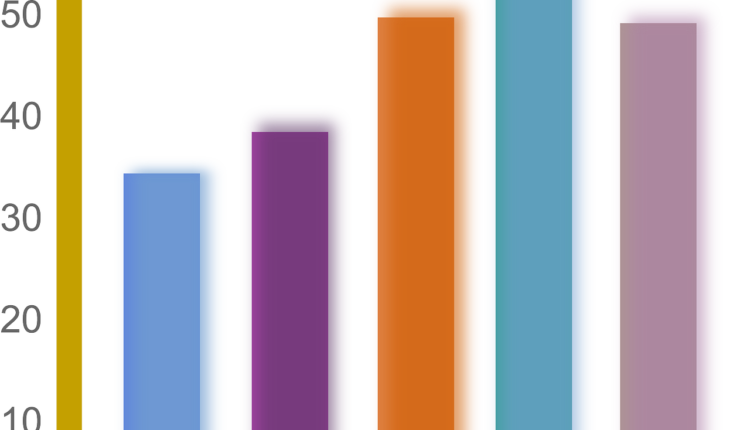

To understand the historical performance of SUK2 share price, let’s look at a hypothetical graph showing the share price movements over the past year:

[Insert hypothetical graph showing SUK2 share price movements over the past year]

From the graph, we can see that SUK2 share price has experienced fluctuations over the past year, influenced by various factors such as company performance, industry trends, and market conditions.

Current SUK2 Share Price Analysis

As of [insert date], the current share price of SUK2 is [insert price]. This represents the price at which SUK2 shares are currently trading in the stock market. It is important for investors to stay updated on the current share price of SUK2 to make informed decisions about their investments.

Forecasting SUK2 Share Price

Forecasting SUK2 share price can be challenging, as it depends on various factors that are subject to change. However, there are several methods that analysts and investors use to forecast share prices, including:

- Fundamental Analysis: This method involves analyzing the financial health and performance of the company represented by SUK2 to determine its intrinsic value. By comparing the intrinsic value to the current share price, investors can assess whether the stock is undervalued or overvalued.

- Technical Analysis: Technical analysis involves analyzing past market data, such as price and volume, to identify patterns and trends that may indicate future price movements. This method is based on the premise that historical price movements can help predict future price movements.

- Market Sentiment: Market sentiment, or the overall attitude of investors towards a particular stock or the market as a whole, can also influence SUK2 share price. Positive sentiment can lead to an increase in share price, while negative sentiment can result in a decrease.

Read more about keystone investment trust share price

Risks Associated with SUK2 Share Price

Investing in SUK2 shares comes with certain risks, including:

- Market Volatility: The stock market is inherently volatile, and SUK2 share price can fluctuate widely in response to market conditions, economic indicators, and company-specific news.

- Company-Specific Risks: SUK2 share price can be affected by factors specific to the company, such as changes in management, product recalls, or legal issues.

- Economic Risks: Economic factors, such as recession, inflation, or geopolitical events, can impact SUK2 share price and overall market conditions.

Conclusion

SUK2 share price is essential for investors looking to make informed decisions about their investments. By monitoring SUK2 share price and staying informed about the factors influencing it, investors can better navigate the stock market and maximise their investment returns.