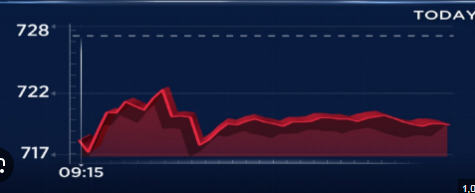

Axis IT&T Share Price

Axis it&t share price, a significant player in the technology solutions realm. In this guide, we’ll delve into the depths of Axis IT&T share price, exploring its importance, factors influencing it, historical performance, and much more.

What is Axis IT&T?

Axis IT&T stands as a stalwart in the technology solutions domain, offering its expertise to a wide array of industries including aerospace, defense & homeland security, automotive, and more. With its inception dating back to 1990, the company has evolved into a trusted engineering partner for global OEMs, providing end-to-end solutions from concept design to after-market support.

Why is Axis IT&T Share Price Important?

The sAxis it&t share price holds significant weight in the eyes of investors and market observers alike. It serves as a barometer of the company’s financial health, growth potential, and overall market sentiment. Understanding this metric is crucial for making informed investment decisions.

Read more about 8k miles share price bse

Axis it&t share price

| Financials (₹ in Cr) | Wipro | Infosys | TCS | HCL Technologies | AXISCADES Tech. |

| Price | 447.65 | 1,420.90 | 3,882.75 | 1,462.30 | 637.80 |

| % Change | -0.16 | 0.46 | 0.26 | -1.02 | 2.18 |

| Market Cap (₹ Cr) | 2,35,437.68 | 5,92,725.48 | 14,16,716.63 | 3,98,230.34 | 2,673.92 |

| Revenue TTM (₹ Cr) | 90,487.60 | 1,46,767.00 | 2,25,458.00 | 1,01,456.00 | 821.62 |

| Net Profit TTM (₹ Cr) | 11,366.50 | 24,108.00 | 42,303.00 | 14,845.00 | -4.80 |

| PE TTM | 20.77 | 24.08 | 30.05 | 25.52 | 65.51 |

| 1 Year Return | 24.71 | 13.49 | 24.72 | 40.81 | 107.86 |

| ROCE | 17.11 | 44.36 | 58.04 | 27.62 | 22.65 |

| ROE | 15.89 | 36.42 | 47.26 | 23.32 | -9.58 |

Factors Influencing Axis IT&T Share Price

Several factors contribute to the fluctuation of Axis IT&T share price:

- Market Demand and Supply Dynamics: Shifts in supply and demand for Axis IT&T shares impact its price on the market.

- Company Performance Metrics: Metrics like revenue, earnings, and growth projections play a pivotal role in determining share price.

- Industry Trends and Competition: The technological landscape and competitive pressures within the industry influence investor perception and, consequently, share price.

- Macroeconomic Factors: Economic indicators, interest rates, and geopolitical events can sway investor sentiment and affect share price.

Historical Performance of Axis IT&T Share Price

Analyzing the historical performance of Axis IT&T share price provides valuable insights into its trajectory over time. By scrutinizing past movements and identifying key events or milestones, investors can glean valuable information to inform their future decisions.

Fundamental Analysis of Axis it&t share price

Fundamental analysis involves evaluating a company’s intrinsic value based on its financial statements and performance indicators. For Axis it&t share price, this entails scrutinizing metrics such as Price-to-Earnings (P/E) ratio, Earnings Per Share (EPS), and revenue growth to gauge its financial health and potential for future growth.

Technical Analysis of Axis IT&T Share Price

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. Traders utilize various tools and indicators, such as moving averages and support/resistance levels, to identify trends and potential entry or exit points in Axis it&t share price.

Analyst Forecasts and Market Sentiment Axis it&t share price

Analyst forecasts and market sentiment play a significant role in shaping investor perceptions of Axis IT&T share price. By tracking analyst recommendations and monitoring market sentiment indicators, investors can gauge prevailing sentiment and anticipate potential price movements.

Read more about wpil share price target

Risks and Challenges At Axis it&t share price

Investing in Axis it&t share price carries inherent risks, including:

- External Factors: Regulatory changes, geopolitical tensions, and economic downturns can adversely affect share price.

- Internal Challenges: Management issues, operational setbacks, and technological disruptions pose risks to the company’s performance and, consequently, its share price.

Investing in Axis it&t share price: Tips for Investors

For investors considering Axis it&t share price as a potential investment opportunity, it’s essential to:

- Conduct thorough research and due diligence.

- Diversify their investment portfolio to mitigate risk.

- Stay informed about market developments and company-specific news.

Conclusion

In conclusion, Axis IT&T share price serves as a vital indicator of the company’s performance and market sentiment. By understanding the factors influencing its price movements and conducting thorough analysis, investors can make informed decisions to navigate the dynamic landscape of the stock market effectively.