RS group share price forecast

In the dynamic world of finance, where uncertainty often reigns supreme, investors continually seek insights into the future performance of companies they are interested in. This is particularly true for rs group share price forecast, a prominent player in the market, where investors keenly anticipate its share price movements.

In this comprehensive guide, we delve into the depths of rs group share price forecast and analysis, unravelling the complexities and shedding light on the factors that drive its valuation.

Understanding rs group share price forecast

rs group share price forecast stands tall as a stalwart in the industry, boasting a rich history and diverse portfolio of products and services. Established years ago, rs group share price forecast has evolved into a powerhouse, with operations spanning multiple sectors including. Its robust financial performance underscores its resilience and adaptability in the face of market challenges.

Factors Influencing rs group share price forecast Share Price

The trajectory of rs group share price forecast share price is influenced by a myriad of factors, both internal and external. Market trends, industry dynamics, and macroeconomic conditions all play pivotal roles in shaping investor sentiment.

Furthermore, company-specific news such as product launches, strategic partnerships, or regulatory developments can trigger significant movements in the share price. Understanding the competitive landscape and rs group share price forecast market positioning is crucial for gauging its future prospects accurately.

Read more about reach plc share price chat

Techniques for rs group share price forecast Forecasting

Forecasting rs group share price forecast share price entails a multifaceted approach, combining various analytical techniques to glean insights into its future trajectory. Fundamental analysis involves scrutinising the company’s financial statements, assessing key metrics such as revenue growth, profitability, and cash flow.

On the other hand, technical analysis relies on chart patterns, trends, and indicators to predict price movements. Additionally, sentiment analysis delves into market sentiment and investor behaviour, providing valuable clues about future market direction.

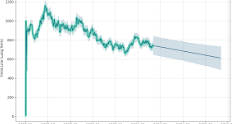

Forecast for the upcoming days

| Date | Price | Min Price | Max Price |

| 2024-04-18 | 8.735 | 8.529 | 8.960 |

| 2024-04-19 | 8.621 | 8.415 | 8.820 |

| 2024-04-22 | 8.657 | 8.436 | 8.882 |

| 2024-04-23 | 8.489 | 8.256 | 8.713 |

| 2024-04-24 | 8.484 | 8.262 | 8.693 |

| 2024-04-25 | 8.456 | 8.223 | 8.687 |

| 2024-04-26 | 8.342 | 8.108 | 8.557 |

Recent Performance and Trends

A thorough examination of rs group share price forecast recent performance and prevailing trends is indispensable for forecasting its share price accurately. Analysing historical price data.

Identifying patterns, and discerning emerging trends offer valuable insights into the company’s growth prospects and potential challenges. Furthermore, benchmarking rs group share price forecast against its industry peers and broader market indices provides valuable context for evaluating its relative performance.

Forecasting rs group share price forecast Share Price

Drawing upon the insights gleaned from fundamental, technical, and sentiment analysis, we endeavour to forecast rs group share price forecast with a degree of confidence.

While no forecasting method can claim absolute accuracy, a judicious blend of quantitative analysis, qualitative judgement, and scenario planning can provide a reasonable approximation of future price movements. It is essential to consider various scenarios and assess the associated risks and uncertainties meticulously.

Risks and Considerations

Despite diligent forecasting efforts, it is imperative to acknowledge the inherent risks and uncertainties that accompany investing in rs group share price forecast. Regulatory hurdles, geopolitical tensions, and unforeseen market developments can disrupt even the most meticulously crafted forecasts. Investors must exercise caution and maintain a diversified portfolio to mitigate potential losses and navigate through turbulent times successfully.

Long-term Investment Perspective

Looking beyond short-term fluctuations, a long-term investment perspective is crucial for realising the full potential of rs group share price forecast growth story. As an investor, it is essential to align one’s investment thesis with rs group share price forecast strategic initiatives, market positioning, and long-term growth prospects. Diversification across asset classes and diligent risk management are key pillars of a sound investment strategy.

Read more about kr1 plc share price

Expert Insights and Recommendations

In seeking to distil the essence of rs group share price forecast, we turn to financial analysts and industry experts for their valuable insights and recommendations. While opinions may vary,seasoned professionals offer valuable perspectives and actionable recommendations for investors considering.

rs group share price forecast shares. It is prudent to weigh these insights carefully and tailor one’s investment strategy to suit individual risk tolerance and investment objectives.

Conclusion

Deciphering the crystal ball of rs group share price forecast share price forecast requires a holistic understanding of the myriad factors at play. By combining rigorous analysis, expert insights, and prudent judgement, investors can navigate the tumultuous waters of the market with confidence.

While uncertainties abound, a well-informed investment strategy anchored in thorough research and due diligence can pave the way for long-term success in the world of finance.