Guj heavy chem share price

Guj heavy chem share price as a company, the factors influencing its share price, historical performance analysis, fundamental and technical analysis, investor sentiment, recent developments, risks and challenges, investment strategies, and much more. Whether you’re a seasoned investor or a novice exploring investment opportunities, this guide will equip you with the knowledge and insights needed to navigate the world of guj heavy chem share price.

Understanding Guj heavy chem share price: Company Overview

Guj heavy chem share price, a prominent player in the chemical industry, has established itself as a leading manufacturer of various chemicals and allied products. With a rich history and a strong market presence, guj heavy chem share price boasts a diverse portfolio of products catering to a wide range of industries including agriculture, textiles, pharmaceuticals, and more.

Importance of Guj heavy chem share price

Guj heavy chem share price serves as a crucial metric for investors, reflecting the market’s perception of a company’s value. Understanding GUJ Heavy Chem’s share price is essential for investors looking to gauge the company’s performance, growth potential, and overall market sentiment.

Read more about color chips media share price

Guj heavy chem share price

| Company Name | Price | % Chg |

| Guj Heavy Chem | 516.00 | 2.30 |

| AMI Organics | 1240.90 | 0.66 |

| Privi Special | 1148.85 | 4.60 |

| Epigral | 1301.95 | 0.53 |

| Laxmi Organic | 252.00 | 0.80 |

Factors Influencing guj heavy chem share price

Several factors influence Guj heavy chem share price, including industry trends, financial performance, regulatory environment, technological advancements, and market sentiment. Analyzing these factors comprehensively can provide valuable insights into the future trajectory of the company’s share price.

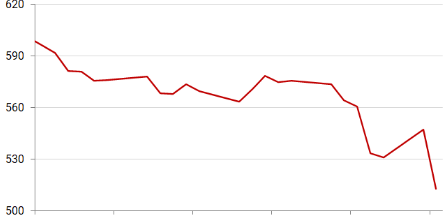

Analyzing Historical Guj heavy chem share price Performance

Examining Guj heavy chem share price performance unveils valuable insights into the company’s growth trajectory, volatility, and response to market conditions. By identifying key milestones and events, investors can gain a better understanding of the factors driving share price movements.

For the year ending March 2023, Guj heavy chem share price declared an equity dividend of 175.00%, amounting to Rs 17.5 per share. At the current share price of Rs 516.40, this results in a dividend yield of 3.39%.

Fundamental Analysis of Guj heavy chem share price

Fundamental analysis involves evaluating various financial metrics and qualitative factors to assess a company’s intrinsic value. Key financial metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio provide valuable insights into Guj heavy chem share price financial health and performance.

Technical Analysis of guj heavy chem share price

Technical analysis involves studying historical price and volume data to identify patterns, trends, and potential price movements. Utilizing charts, indicators, and technical patterns, investors can make informed decisions regarding entry and exit points in the market.

Investor Sentiment and Market Perception Guj heavy chem share price

Investor sentiment plays a significant role in influencing Guj heavy chem share price. Analyzing analyst recommendations, institutional investor holdings, and market sentiment indicators provides valuable insights into market perception and potential future movements.

Recent Developments and News Impact Guj heavy chem share price

Staying abreast of recent developments and news related to guj heavy chem share price is crucial for understanding the company’s current position and future prospects. Market reactions to news events can significantly impact share price movements, making it essential for investors to stay informed.

Risks and Challenges At Guj heavy chem share price

Despite its potential for growth, guj heavy chem share price faces various risks and challenges, including industry-specific risks, regulatory challenges, and economic uncertainties. Understanding and mitigating these risks are vital for investors looking to make informed investment decisions.

Read more about gujarat poly avx electronics ltd share price

Investment Strategies and Recommendations

Based on comprehensive analysis and insights gained, investors can formulate suitable investment strategies tailored to their risk tolerance, investment objectives, and time horizon. Whether considering long-term investments or short-term trading opportunities, having a well-defined strategy is essential for success.

Conclusion

Understanding guj heavy chem share price dynamics requires a holistic approach encompassing fundamental analysis, technical analysis, investor sentiment, and market perception. By delving deep into these aspects, investors can gain valuable insights into the company’s performance, growth potential, and future prospects, enabling them to make informed investment decisions.